FP34C Report

This report is used to summarise EPSR2 dispensing statistics for inclusion in the FP34C submission document.

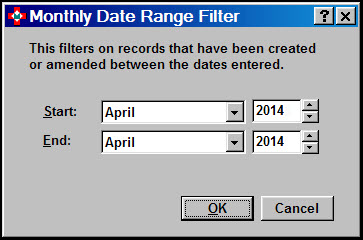

The figures returned are for calendar monthly intervals. A report can cover more than two or more separate months.

The default Start and End dates are for the current month.

The report will always include figures that apply within the range so if Feb-2014 to Feb-2014 was selected the report would include figures between 1st February 2014 and 28th February 2014 inclusive.

The Start date must always precede or equal the End date.

When the dates are not valid the OK button will be disabled, preventing further progress.

Filtering dates

- Click the Reports tab.

- Select the EPSR2 claims (FP34c) report.

- Check the Month date range filter.

- If the default dates do not cover the period on which you wish to report, click the drop-down arrow adjacent to the either the Start and End months, or both in turn.

- Select the required month.

If necessary, adjust the corresponding year.

- Click the <Spinner> and use the down arrow to decrease the year. Correspondingly use the up arrow to increase the year.

- Click the OK button to apply the date range filter.

- Click OK again to preview the report on screen.

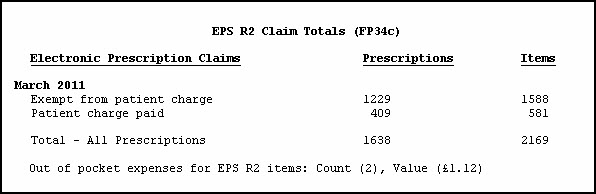

When the report is run it will proceed through the months that are included in the specified date range.

- A count is only made for prescriptions for which notification has been made within the specified month e.g. March 2018.

- A count is only made for prescriptions which were claimed in the month specified (e.g. March 2018) or claimed within the first five days of the following month e.g. April 2018.

<Note icon> A claim made in the first five days of the month following the specified month will still be included in the specified month's figures if the notification was made within the specified month.

Examples

<Claim form>

The number of prescription forms (shown here as green squares) is determined by the number of EPSR2 messages. The split between exempt (exempt from charge items) and paid (patient charge paid items) prescription forms is determined by the exemption status of the patient at the time a claim was made for that prescription (shown here as red squares). However there are exceptions to this general rule.

The calculation as to what item figure goes where on the submissions claim form is based on the following:

Claimable professional fees minus patient charges equates to the number of exempt fees (exempt from charge items - upper red squares)

This exempt fee value can never be a negative value. If the “sum” were to provide such a result, the number of exempt fees is recalculated as zero.

Claimable professional fees minus exempt fees equates to the number of paid fees (patient charge paid items - lower red squares).

In this regard, the table represents a sample of common or unusual products.

|

Patient pays for prescriptions |

Claimable prof fees |

Patient charges |

Exempt fees |

Paid fees |

|

1P x Simvastatin 40mg |

1 |

1 |

0 |

1 |

|

1P x Microgynon 30 (no charge oral contraceptive) |

1 |

0 |

1 |

0 |

|

1P x HRF 100mcg injection |

2 |

1 |

1 |

1 |

|

1P x Prempak C (e.g. 1 months supply) |

2 |

2 |

0 |

2 |

|

1P x Activa C1 Bk Ct Lg Blk Circ-Kn–2pk - 2 stockings |

1 |

2 |

0 |

1 |

|

1P x Item + 1P x additional item (cream & applicator) |

2 |

1 |

1 |

1 |

|

1P x Warfarin 4mg (1mg & 3mg) |

2 |

1 |

1 |

1 |

|

2P x Simvastatin 40mg |

1 |

1 |

0 |

1 |

|

2P x Microgynon 30 (no charge oral contraceptive) |

1 |

0 |

1 |

0 |

|

2P x HRF 100mcg injection |

2 |

1 |

1 |

1 |

|

2P x Prempak C (e.g. 2 months supply) |

2 |

2 |

0 |

2 |

|

2P x Activa C1 Bk Ct Lg Blk Circ-Kn–2pk – 4 stockings |

1 |

4 |

0 |

1 |

|

2P x Item + 1P x additional item (cream & applicator) |

2 |

1 |

1 |

1 |

|

2P x Warfarin 4mg (1mg & 3mg) |

2 |

1 |

1 |

1 |

Expensive items

When expensive items have been dispensed, they are included on the Pharmacy Manager FP34 report to reflect the way they are itemised on the payment schedule.

This will help ensure that reimbursement is correctly made and losses are not incurred, this report allows you to be able to compare the actual expense incurred with the value that is subsequently reimbursed as detailed on the schedule of payments.

An expensive item is a single dispensed item with a net ingredient cost of £100.00 or more.

For reporting purposes there are two bands - items with an NIC of £100.00 up to £300.00 and all those above £300.

See also Thresholds for amending the threshold NIC limits.

Whether to include a prescription in the current month's figures

Determination is made as to whether a prescription should be counted in the current month's figures or next month's figures.

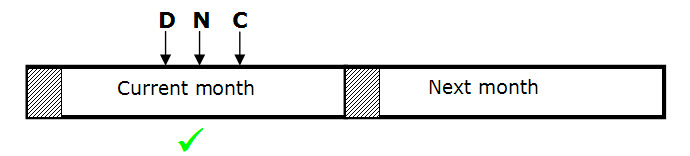

Scenario 1

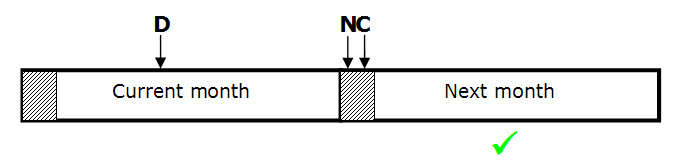

If the prescription was dispensed (D), notified (N) and claimed (C) in the current month, then the prescription will be included in the figures for the current month.

Scenario 2

If the prescription was claimed (C) in the next month before the cut-off point (day five), but was notified (N) in the current month, the prescription will be included in the figures for the current month.

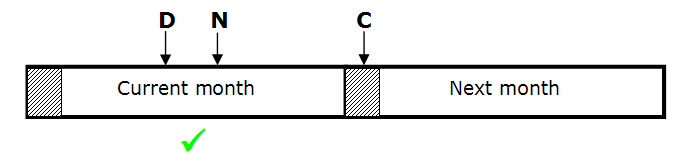

Scenario 3

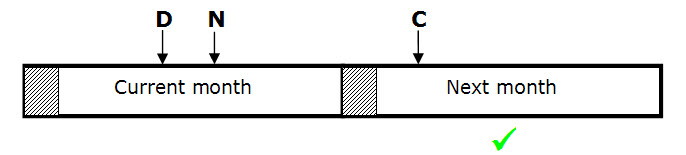

If the prescription was dispensed (D) in the current month, but claimed in the next month but before the cut-off point, but the notification (N) was not carried out in the current month, then the prescription will be included in the figures for the next month. It will not be included in the current month's figures.

Scenario 4

If the prescription was claimed (C) in the next month but after the cut-off point, the prescription will be included in the next month's figures regardless of when it was notified and therefore will be ignored for the current month's figures.

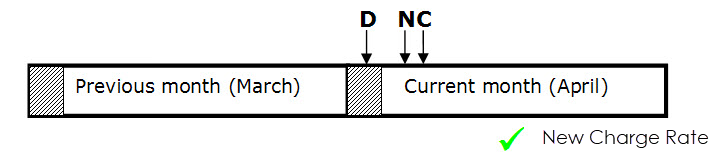

Whether to count against the old charge rate or new

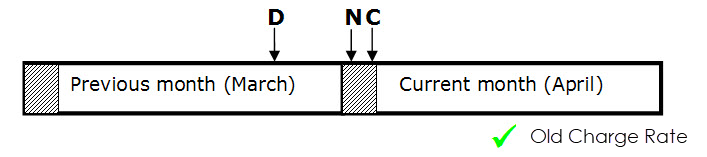

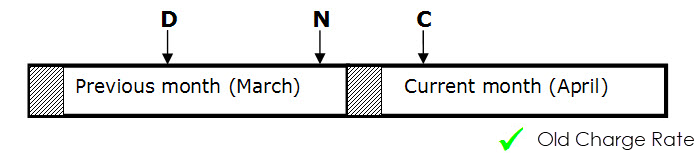

When the NHS introduce a new prescription charge rate there may be occasions where a prescription that is included in the counts for the current month will be charged at the previous month’s rate. In the examples below the charge rate changed on the 1st of April.

The following scenarios may exist, overlapping the period when there is an NHS charge increase:

-

A prescription is dispensed (D) in March but notified (N) and claimed (C) in first five days of April will be included in the April payment at the old rate:

-

A prescription is dispensed (D) and notified (N) in March but claimed (C) in April after the first five days will be included in the April payment at the old rate:

When the figures are to be included in April’s counts but the prescription was dispensed in March the figures will be added up against the old NHS charge counts.

In this situation there will be two sets of prescription form and item counts where a charge was made to the patient indicating how many of them were from the old rate and how many of them were from the new NHS charge.

New Charge Rate

Prescriptions that are dispensed (D), notified (N) and Claimed (C) in April will be included in the April payment at the new rate:

The NHS Totals (FP34) Report records all prescription statistics including paper prescriptions plus EPSR1 and EPSR2 types. The FP34C report covers EPSR2 prescriptions only, once they have been claimed.